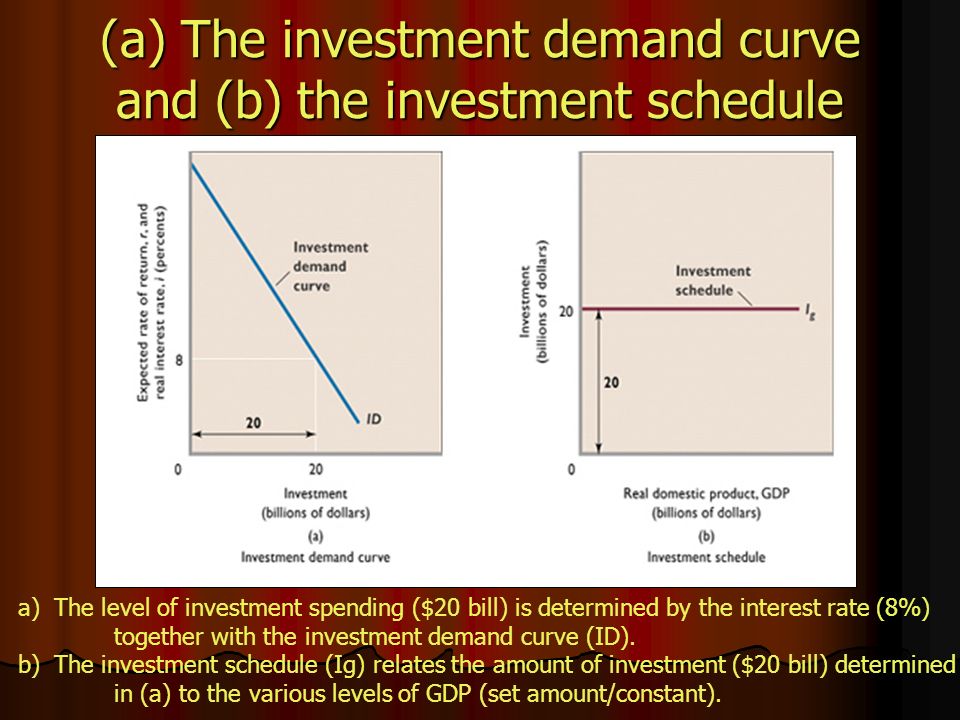

Investment Demand Model ~ Indeed lately has been sought by consumers around us, maybe one of you. People are now accustomed to using the net in gadgets to see image and video data for inspiration, and according to the title of this post I will discuss about Investment Demand Model. In the keynesian model of goods mar ket equilibrium we also now introduce the rate of interest as an important determinant of investment. Aggregate demand c i g nx where. In the basic is lm model i assume the government sets the supply of money at a specific level. C consumer spending on goods and services i private investment and corporate spending on non final capital goods factories equipment etc g. With this introduction of interest as a determinant of investment the latter now becomes an endogenous variable in the model. Investment in health takes the form of medical care purchases and other inputs and depreciation is interpreted as natural deterioration of health over time. It is based on the theory of john maynard keynes presented in his work the general theory of employment interest and money it is one of the primary simplified representations in the modern field of. The classical model labor marketm the demand for labor equilibrium in the labor market aggregate supply the price level and the quantity theory of money interest rate consumption and investment. The demand system of the model to estimate the parameters characterizing the sectoral composition of investment and consumption goods and we estimate the rest of parameters by asking the model to produce a hump of investment as in the data. 13 4 b that the increase in housing price increases residential investment. Our results are as follows. 4 a shows that an expansionary shift in demand raises equilibrium price which shows in fig. First the model reproduces well the stylized evolution of the investment. Generally on average the investment demand curve is inelastic. The ad as or aggregate demand aggregate supply model is a macroeconomic model that explains price level and output through the relationship of aggregate demand and aggregate supply. The diagrammatical representation of the investment demand curve gives a curve which is known as the investment demand function or the marginal efficiency of capital curve. The rise in interest rate which will cause reduction in investment demand and consumption demand and help in controlling inflation. Interest rates adjust throughout the economy affecting investment and consumption demand and thereby the equilibrium national income of the is lm model of the demand side of the economy until the demand for money equals the supply of money. The demand curve can shift for an economic boom a large increase in population and a fall in interest rate. The aggregate demand is determined by consumption demand and investment demand.

C consumer spending on goods and services i private investment and corporate spending on non final capital goods factories equipment etc g. In this model health is a durable capital good which is inherited and depreciates over time. Interest rates adjust throughout the economy affecting investment and consumption demand and thereby the equilibrium national income of the is lm model of the demand side of the economy until the demand for money equals the supply of money. If you re looking for Investment Demand Model you've come to the perfect place. We have 12 graphics about investment demand model adding images, photos, photographs, backgrounds, and more. In these page, we additionally have variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

The demand system of the model to estimate the parameters characterizing the sectoral composition of investment and consumption goods and we estimate the rest of parameters by asking the model to produce a hump of investment as in the data.

13 4 b that the increase in housing price increases residential investment. The demand curve can shift for an economic boom a large increase in population and a fall in interest rate. Interest rates adjust throughout the economy affecting investment and consumption demand and thereby the equilibrium national income of the is lm model of the demand side of the economy until the demand for money equals the supply of money. C consumer spending on goods and services i private investment and corporate spending on non final capital goods factories equipment etc g.