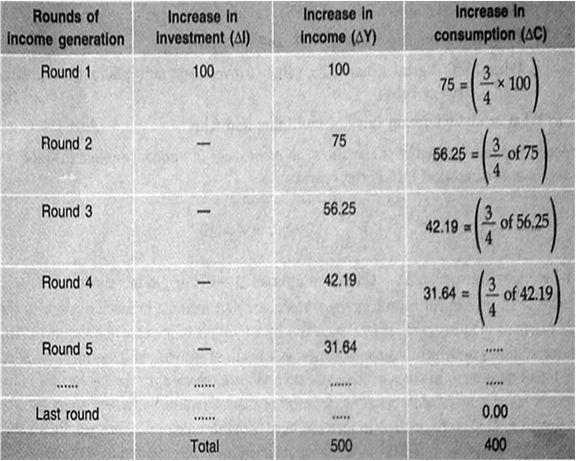

Investment Multiplier Formula Economics ~ Indeed recently is being sought by users around us, perhaps one of you personally. People are now accustomed to using the net in gadgets to see image and video information for inspiration, and according to the title of this article I will discuss about Investment Multiplier Formula Economics. The concept of investment multiplier. At the equilibrium point of e saving and investment are equal and income is rs 300 crore. The formula to calculate money multiplier is represented as follows. Here ox measures national income and oy saving and investment. 3 19 where c 1 g1 is the initial aggregate demand schedule. Its formula i e k g is. Graphic presentation of multiplier. Multiplier formula denotes an effect which initiates because of increase in the investments from the government or corporate levels causing the proportional increase in the overall income of the economy and it is also observed that this phenomenon works in the opposite direction too the decrease in income effects a decrease in the overall spending. Importance of the investment multiplier. Firstly ascertain the value of money deposited at the bank which can be in the form of a recurring account savings account current account fixed deposit etc. Keynes theory of investment multiplier is con sidered to be an important and permanent contribu tion to economic theory. Formula for money multiplier calculation. Other types of fiscal multipliers can also be calculated like multipliers that. In addition it will also be shown how s i. Kahn in his article the relation of home investment to unemployment in the economic journal of june 1931. Multipliers can be calculated to analyze the effects of fiscal policy or other exogenous changes in spending on aggregate output. Money multiplier can be defined as the kind of effect which can be referred to as the disproportionate rise in the amount of money in a banking system that results from an injection of each dollar of the reserve. The theory of multiplier occupies an important place in the modern theory of income and employment. For example if an increase in german government spending by 100 with no change in tax rates causes german gdp to increase by 150 then the spending multiplier is 1 5. What is the multiplier formula in economics.

The formula for k g is the same as the simple investment multiplier represented by ki. Kahn in the early 1930s. Saving curve ss intersects original investment curve ii at e. If you are searching for Investment Multiplier Formula Economics you've come to the right place. We have 12 graphics about investment multiplier formula economics including pictures, photos, photographs, backgrounds, and much more. In these webpage, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Graphic presentation of multiplier.

The concept of multiplier was first developed by r f. The impact of a change in government spending is illustrated graphically in fig. Firstly ascertain the value of money deposited at the bank which can be in the form of a recurring account savings account current account fixed deposit etc. Importance of the investment multiplier.